A. Subrahmanyam, K. Tang, J. Wang, X. Yang

Available at SSRN 3554486, 2021

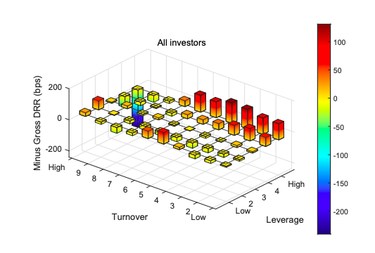

We use proprietary data on intraday transactions at a futures brokerage to analyze the link between implied leverage, trading performance, and the sources of profits/losses, conditional on investor skill. We measure skill during a training period, and analyze performance out of sample. Levered positions stimulate de facto liquidity provision by skilled investors, who earn 19.3 bps per leverage unit. Unskilled investors’ leverage amplifies their losses, particularly those stemming from gambling proclivity. Across all individuals and institutions, forced liquidations largely account for the negative impact of leverage on performance. Regulatory increases in required margins decrease (enhance) skilled (unskilled) investors’ performance.

@article{subrahmanyam2021leverage,

title={Leverage is a Double-Edged Sword},

author={Subrahmanyam, Avanidhar and Tang, Ke and Wang, Jingyuan and Yang, Xuewei},

journal={Available at SSRN 3855181},

year={2021}

}